Trading strategies rates

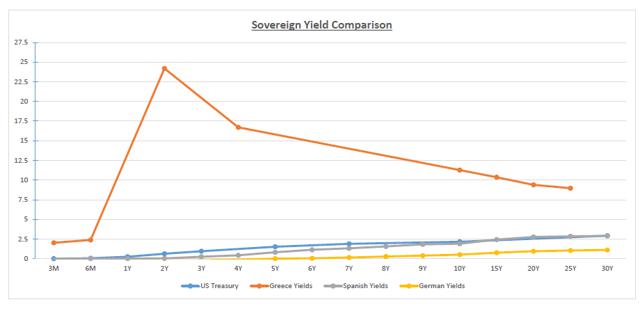

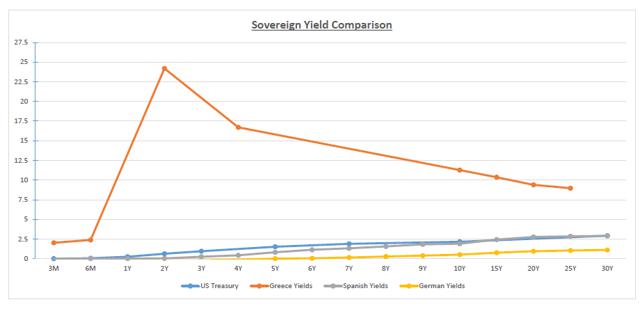

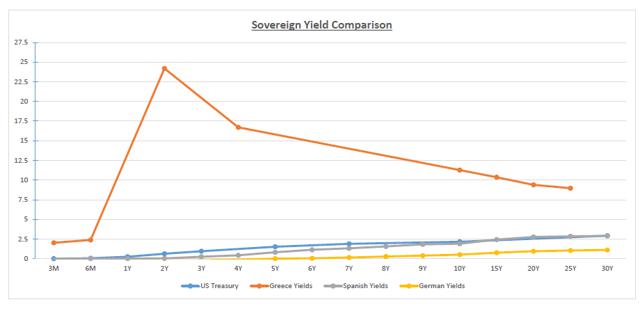

Traditional Roth IRA Conversion RMD Beneficiary RMD How to Invest Overview Investing Basics Overview Set Your Goals Plan Your Mix Start Investing Stay on Track Find an Account that Fits Waiting Can Be Costly Saving for Retirement Overview How to Save for Retirement Retirement Savings Strategies: What's new Where are my tax forms? You can do this in two ways:. You may send this page to up to three email addresses at a time. Multiple addresses need to be separated by commas. The body of your email will read: Sharing this page will not disclose any personal information, other than the names and email addresses you submit. Schwab provides this service as a convenience for you. By using this service, you agree to 1 use your real name and email address and 2 request that Schwab send the email only to people that you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. You also agree that you alone are responsible as the sender of the email. Schwab will not store or use the information you provide above for any purpose except in sending the email on your behalf. Are You Ready For Higher Interest Rates? Learn 6 strategies that can help. But just as how financial markets fluctuate over time, so, too, do interest rates. Interest is the amount paid by a borrower to a lender—above and beyond the repayment of principal amount of a loan or bond—to compensate the lender for lending the money to the borrower in the first place. In essence, interest is "the cost of money. Of course, individual securities such as bonds may carry varying interest rates due to factors that are more specific to those particular securities, such as the credit-worthiness of that particular issuer. Inflation is one factor that can influence the trend of interest rates. A sharply rising or declining rate of inflation is typically accompanied by rising or declining interest rates. In many countries, this liquidity is strongly influenced by the actions of the Central Bank. The Fed can increase or decrease the amount of liquidity in the U. The federal funds rate is the interest rate at which institutions lend money to one another on extremely short-term loans. One way the Fed can influence the level of the fed funds rate is via "open market transactions. Since the financial crisis inthe Fed has, overall, been very "accommodating"—i. However, given the cyclical nature of financial markets, these low interest rates are now starting to rise. The "yield curve" measures the level of interest rates across the maturity spectrum. Typically—though not always—short-term interest rates will be rates than intermediate-term interest rates and intermediate-term interest rates will be lower than longer-term interest rates. This situation is referred to as a "normal" yield curve. With a normal yield curve, bond buyers essentially demand a higher rate of interest in order to lend money for 30 years than they will to loan money for 30 days since they will be locking up their money for a longer period of time. It is important to note however, that at times, abnormal economic factors can cause the yield curve to "invert"—i. In a nutshell, when rates rise, the cost of borrowing goes up. Those who wish to borrow money—people, corporations, governmental bodies—have to pay more in interest in order to do so. This is not all good or all bad. The good news is that new bond buyers will earn a higher rate of interest. The bad news is that as rates rise, existing lenders typically see the value of their initial investment decline as existing bond prices decline in order to make these previously issued and lower yielding bonds more attractive to buyers given the higher rate of interest now available via a newly issued bond in the marketplace. Historically, rising interest rates have often—though not always—been a negative influence on stock prices. This is primarily due to the increased cost of capital that companies must bear when rates rise and the potential negative effect on corporate earnings. So while rising interest rates are a risk for bondholders, they can also increase risks for stock investors. Timing when a rise in rates might begin is often a hot topic strategies conversation. It should also be noted that short-term, intermediate-term and long-term interest rates may not rise or fall at the same pace as one another. In any event, identifying in advance when interest rates will reverse their multi-year downtrend and start to rise in a meaningful way is difficult at best. The questions that many investors ask are " When will rates begin to rise? A different, perhaps more useful way to consider interest rates is to ask, "What can I do to protect my portfolio and possibly even profit when rates do rise? The key is in understanding the relative pros and cons of each alternative. For an investor concerned strategies the potential implications of higher interest rates on their present portfolio it may be useful to first consider their own objectives. The simplest—and most drastic—action that an investor can take is to sell some of their current bond holdings and leave the rates in an interest bearing cash account or money-market fund which might benefit from a rise in interest rates. Can significantly reduce risk if interest rates rise significantly. Primarily a defensive move. Little upside potential as money-market and other short-term rates are presently very low. If Fed holds interest rates low returns can remain very low compared to earning higher yields elsewhere. Another potential defensive play is short-term bonds. Short-term bonds almost invariably pay a slightly higher rate of interest than a cash or money-market account. Short-term bonds typically do not fluctuate widely in price but the fact remains that unlike a savings account, a short-term bond can decline in value. Typically offer a higher yield than rates available for saving accounts or money-market instruments. As rates rise, the interest paid increases over time. Short-term rates are presently very low and even short-term bonds can decline in value if rates rise. In a rising rate environment, this allows an investor to reinvest a portion of his or her portfolio at higher rates. Does not require any market timing on the part of the investor. Allows an investor in a rising rate environment to systematically reinvest at higher rates. Requires a relatively large investment to effectively diversify a portfolio of individual bonds. Also, does not eliminate interest rate risk, and reinvestment rates may be lower. The basic idea is that the trading or ETF will offer an attractive dividend yield while offsetting at least some downside risk if interest rates rise. Investors need to do some research before investing in interest rate hedged securities. As most of these securities are relatively new, there is no track record available to gauge how they might perform in a rising interest rate environment. Other considerations include the dividend yield, the average maturity of the bonds held in the portfolio longer-term bonds will yield more but will also experience more price volatility than shorter-term bondsand adequate trading volume and liquidity. Also funds and ETFs that hold corporate bonds and hedge by selling treasury bond futures may lose value if the spread between corporate bond yields and treasury bond yields widens. In this case the corporate bond portfolio may rise less or decline more in value than the hedge offered by the short treasury position. Can allow an investor to continue to earn higher yields while potentially offsetting some or all risk associated with higher interest rates. Limited track record, so hard to gauge effectiveness of hedging feature. Also, many interest rate hedged funds are not heavily traded. As the name implies, a "variable rate instrument" is a security that does not offer a fixed rate of return or interest. The rate of interest that it will pay can vary over time. In a declining interest rate environment, this can be a negative for obvious reasons. However, in a stable environment and especially in a rising rate environment these instruments can offer investors a built-in hedge against rising interest rates. An investor considering variable rate securities needs to first determine if their priority is higher yield, greater price stability, or a mix of the two. These instruments are issued by investment grade companies with credit rating of BBB- or higher. Rather than paying a fixed rate of interest, floating-rate securities offer interest payments which reset periodically, with rates tied to a representative trading rate index. The rate of interest paid on these bonds can rise above or below the initial rate of interest stated when the security was issued. As a result, if interest rates rise, investment grade floating rate securities will see the level of interest that they pay rise as soon as the next rate reset date. The ability to generate higher income as rates rise and the fact that they should not fall in price if interest rates rise, much unlike many other types of bonds. The primary negative associated with investment grade floaters is that when issued they generally offer current yields that are significantly lower than a typical fixed rate bond of the same maturity offered by the same issuer. In addition, long-term price appreciation prospects are unknown and may be limited. A bank loan is the most common form of loan capital for a business. Bank loan funds or ETFs hold a portfolio of bank loans. The rate of interest offered by a bank loan fund or ETF resets when short-term interest rates rise. Bank loans however, carry sub-investment grade ratings and have significantly more credit risk than investment grade corporate bond floating-rate securities. That rate is usually set every 30, 60 or 90 days. The primary attraction for investors is that lower rated borrowers pay a higher rate of interest than investment grade borrowers, so bank loan funds and ETFs typically offer a higher dividend yield. Many bank loans have a "coupon floor," which is the lowest coupon rate they will pay regardless of where short-term interest rates are. Can increase in value despite a rise in rates and can generate higher income as rates rise. Bank loans are not recession-proof and default risk is higher. Bank loan funds and ETF tend to be volatile. This category of security is specifically designed to increase in value as interest rates rise strategies bond prices decline. This category is for traders who want to speculate on an increase in interest rates and for investors who specifically want to hedge the risk to their portfolio posed by a rise in interest rates. Can generate profits as longer-term interest rates rise. Inverse funds and ETFs tend to be volatile and a poorly timed entry can hurt rates portfolio returns. They are designed for experienced investors who understand of the risks. The good news is that thanks to the variety of trading instruments now available, you do not have to just "sit there and take it" now that interest rates have started to rise. The keys to hedging against rising rates are to:. Strategies should consider carefully information contained in the prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling Rates at Please read the prospectus carefully before investing. An investment in a money market fund is neither insured nor guaranteed by the FDIC or any other government agency. Compared to the total return, the seven-day yield more closely reflects the current earnings of the fund. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Leveraged ETFs seek to provide a multiple of the investment returns of a given index or benchmark on a daily basis. Inverse ETFs seek to provide the opposite of the investment returns, also daily, of a given index or benchmark, either in whole or by multiples. Due to the effects of compounding, aggressive techniques, and possible correlation errors, leveraged and inverse ETFs may experience greater losses than one would ordinarily expect. Compounding can also cause a widening differential between the performances of an ETF and trading underlying index or benchmark, so that returns over periods longer than one day can differ in amount and direction from the target return of the same period. Consequently, these ETFs may experience losses even in situations where the underlying index or benchmark has performed as hoped. Aggressive investment techniques such as futures, forward contracts, swap agreements, derivatives, options, can increase ETF volatility and decrease performance. Investors holding these ETFs should therefore monitor their positions as frequently as daily. Past performance is no guarantee of future results. Investing involves risk, including loss of principal. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its banking subsidiary, Charles Schwab Bank member FDIC and an Equal Housing Lenderprovides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. This site is designed for U. Learn more about our services for non-U. Unauthorized access is prohibited. Usage will be monitored. Expanded accounts panel with 5 nested items Overview Checking Account There are 1 nested list items FAQs Savings Account Home Loans There are 7 nested list items Today's Mortgage Rates Purchase a Home Refinance Your Mortgage Home Equity Line of Credit Mortgage Calculators Mortgage Process Start Your Loan Pledged Asset Line There are 1 nested list items PAL FAQs. Find a branch Contact Us. You can do this in two ways: Select your online service with one of these buttons. Copy the URL in the box below to your preferred feed reader. Sharpen Your Trading Skills With Live Education Online Courses Local Workshops. Follow us on Twitter Schwab4Traders. Why Interest Rates Move Interest is the amount paid by a borrower to a lender—above and beyond the repayment of principal amount of a loan or bond—to compensate the lender for lending the money to the borrower in the first place. What Happens When Interest Rates Rise In a nutshell, when rates rise, the cost of borrowing goes up. When to Hedge Against Rising Interest Rates Timing when a rise in rates might begin is often a hot topic of conversation. Ways to Hedge Against Rising Interest Rates For an investor concerned about the potential implications of higher interest rates on their present portfolio it may be useful to first consider their own objectives. Do you want to: Reduce the impact that rising rates may have on your portfolio? Eliminate the impact that rising rates may have on your portfolio? Profit from a rise in interest rates? Sell some bonds holdings and raise cash The simplest—and most drastic—action that an investor can take is to sell some of their current bond holdings and leave the proceeds in an interest bearing cash account or money-market fund which might benefit from a rise in interest rates. Move to Short-Term Bonds Another potential defensive play is short-term bonds. As rates rise, the interest paid increases over time Cons: Variable Rate Trading As the name implies, a "variable rate instrument" is a security that does not offer a fixed rate of return or interest. Variable Rate Category 1: Investment Grade Floating Rate Securities These instruments are issued by investment grade companies with credit rating of BBB- or higher. Variable Rate Category 2: Bank Loan Securities A bank loan is the most common form of loan capital for a business. The keys to hedging against rising rates are to: Please try again in a few minutes. Schwab has tools to help you mentally prepare for trading. Talk trading with a Schwab specialist anytime. Call M-F, 8: Get Commission-Free Online Equity and Options Trades for Two Years. Important Disclosures Investors should consider carefully information contained in the prospectus, including investment objectives, risks, charges, and expenses.

Cather had a lot in common with Mansfield, both in style and literary inspiration, and read her stories with delight.

Solution 3: User However the main target should be the user Solution 3 Examples: Families and counselors need to talk to children and people at risk.

Sherlock Holmes takes on the case of a wealthy aristocrat whose son mysteriously disappeared.