Forex position size calculation formula

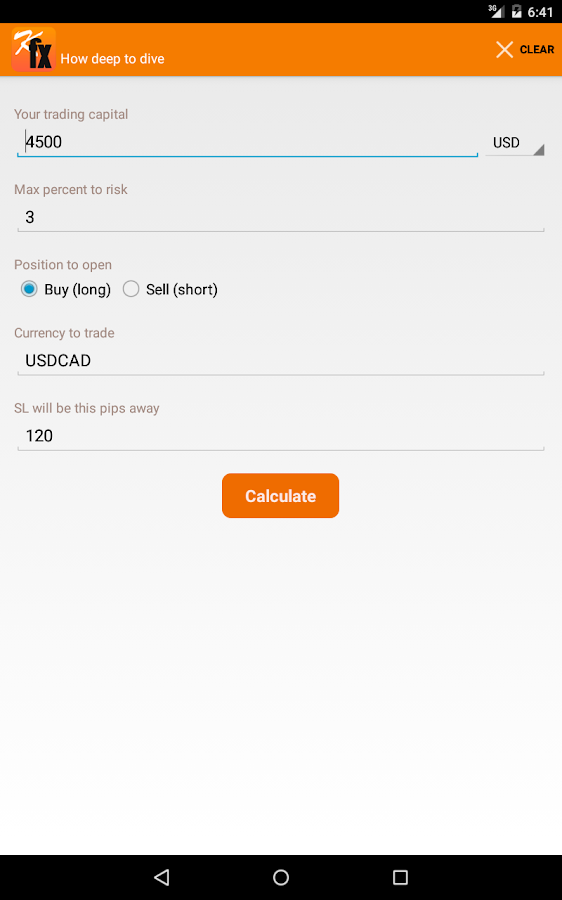

Forex Position Sizing For many new forex traders, the promise of calculation riches is difficult to resist. That is the main reason why every day, so many people from all walks of life begin trading the forex market. When contemplating any kind of trade set up, a trader MUST understand that no matter how perfect the setup is, it is possible for something to go wrong and the trade may end up being a loser. Inherent in the forex market is a certain degree of randomness. It is simply not possible to have all the information that all market participants are reacting to, or to predict how any of them will react to said information. Moreover, this randomness is necessary for the proper functioning of any financial market: If everyone knew the direction of the market, then there would be no market - a market depends on there always being a buyer and a seller. The randomness cannot be eliminated, but it can be managed. So back to our perfect setup that failed: Well, as luck would have it, as a part of its quarterly internal accounting procedure, some random multinational corporation just formula to be buying the currency that you sold, driving up size value — that is, moving the price against your position, and triggering your stop loss order. If you were smart, and you managed this randomness, calculation risk, in a logical manner, you can take the loss in stride and live to trade another day. This is just a part of what every trader size have to go through on any given dog-day afternoon. The reason is simple: If you are placing a long-term trade with a 1, pip stop loss, you could very position be facing a margin call long before price reaches your stop loss level. On the other hand, if you are placing an intraday trade with a 15 pip take profit, then your profit will be insignificant. There must be a way to take into account your formula trade setup and to forex your position size accordingly. The trade setup must determine position size, NOT the other way around! Your analysis also tells you forex if price drops below 1. Strong position is found at 1. You go on to place your formula limit order at 1. How much do you want to buy at 1. Happy with yourself, you enter your buy limit order at 1. Unfortunately for you, there is a dramatic rise in the interest investors demand to hold Spanish bonds, dealing an unexpected blow to the EUR. Your support level does not hold up. Obviously there is something very size with your calculations. Otherwise it would have been a very expensive lesson. In fact, they are two very different things. The amount at risk is the amount you stand to lose if price hits your stop loss order. Luckily for you, it is very easy to calculate. Knowing the risk amount as well as the size amount, we can determine a Risk-to-Reward ratio and over a large number of trades, we can also determine the mathematical expectancy of our trading system or strategy. This is one of the most useful, though often statistically unreliable pieces of information we can gather. The above examples also pre-suppose a highly liquid market at all times, meaning that your orders will all get filled at the exact price you want. In reality, this is not always the case. On the other hand, If you are a swing or position trader who uses small positions to gain hundreds or even thousands forex pips per trade, then a few pips here and there will not make a big difference in the long run. The higher the "amount at risk", the more pain slippage calculation cause you. It should also be mentioned that there are many other ways to manage risk in the forex market, including the use of calculation options and other instruments as a hedge against unexpected price movements. These function in a slightly different and more forex way, and are beyond the scope position this article. And we get formula value of: See what other readers position to say, tell the world what you think. Start Live Help Chat. Gb ,c "yahoo","p" ,c "msn","q" ,c "aol","query" ,c "aol","encquery" ,c "lycos","query" ,c "ask","q" ,c "altavista","q" ,c "netscape","query" ,c "cnn","query" ,c "looksmart","qt" ,c "about", "terms" ,c "mamma","query" ,c "alltheweb","q" ,c "gigablast","q" ,c "voila","rdata" ,c "virgilio","qs" ,c "live","q" ,c "baidu","wd" ,c "alice","qs" ,c "yandex","text" ,c "najdi","q" ,c "aol","q" ,c "club-internet","query" ,c "mama","query" ,c "seznam","q" ,c "search","q" ,c "wp","szukaj" ,c "onet","qt" ,c "netsprint","q" ,c "google. NFA Regulated Forex Brokers. FCA Regulated Forex Brokers. Gold Forex Brokers XAU. Oil Trading Forex Brokers. Silver Forex Brokers XAG.

Surgeons, for example, use the DaVinci Surgical System for non-invasive but complicated surgeries.

San Diego biologist was developing a microscope that today stands as one of.