Moving average in forex trading

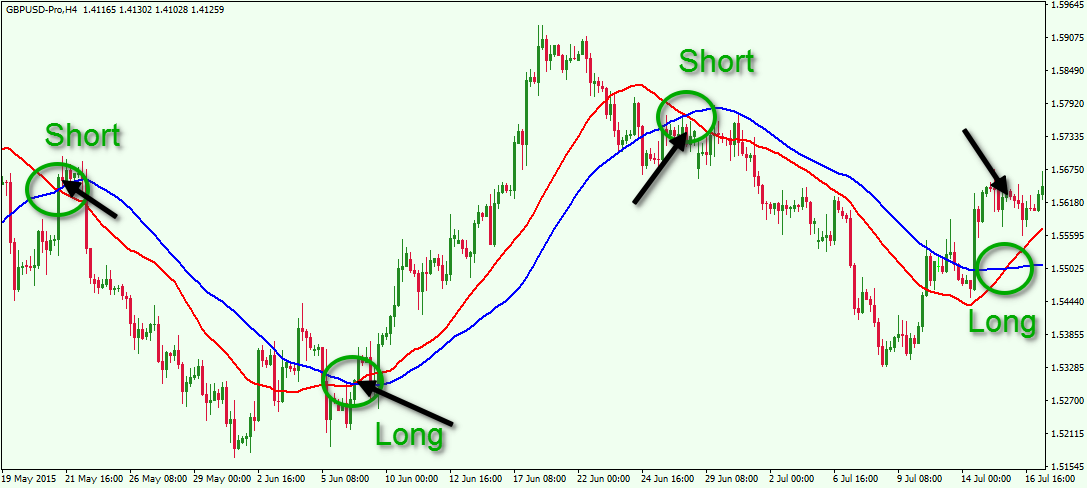

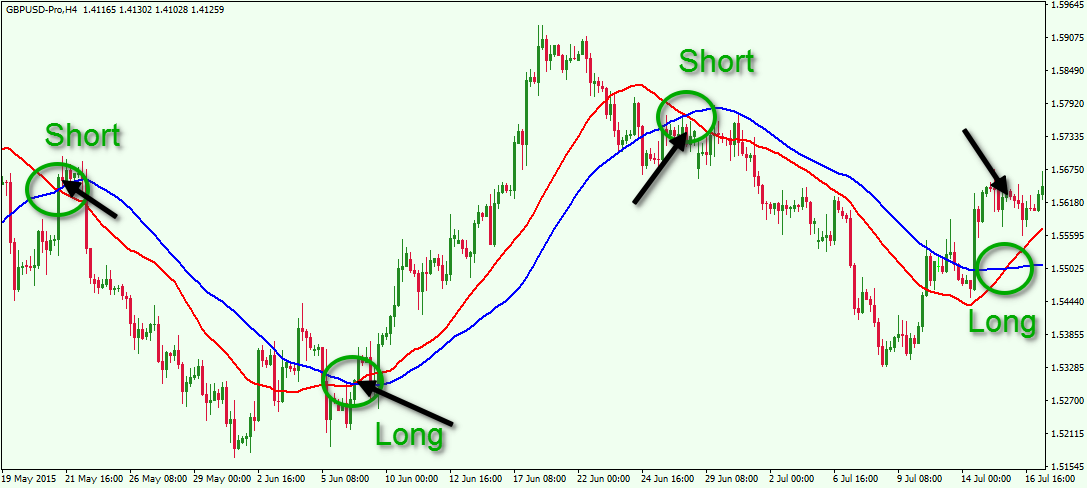

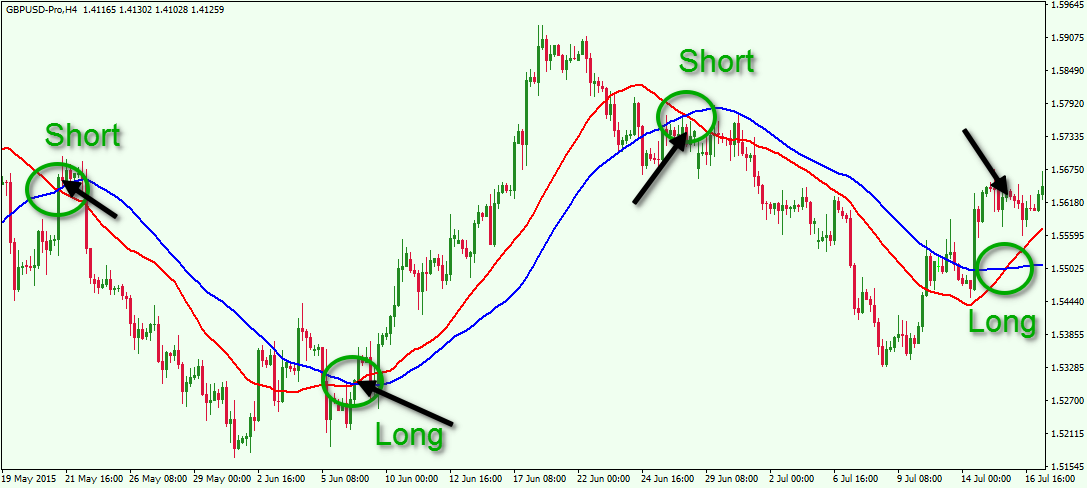

Moving averages may seem boring compared to other technical indicatorsbut there is more than meets the eye when it comes to this simple tool. Not only are moving averages used as directional indicators in the forex FX market, many funds and speculators have used them in other methodsincluding key resistance and support levels, as well as for spotting turnarounds in the market. As a result, volatility and market fluctuations accompany the placement of moving averages in the currency market much in the same capacity as the Fibonacci retracement. These situations offer plenty of profit and trading opportunities for the FX trader, but picking out these situations takes patience. In this article, we'll show you how to take hold of these opportunities in your trading. Setting the Stage With a broader notion of the market, the simple moving average can be compared to the original market sentiment application first intended for the indicator. At first glance, traders use the indicator to compare the current closing price to historical or previous closing prices over a specified number of periods. In theory, the comparison should show the directional bias that would accompany other analyses, either fundamental or technical, in working to place a trade. Following some mild consolidation in the beginning ofbullish buying took over the market and drove prices higher. Here, chartists can confirm the directional bias, as the long-term measure is indicative of the large advance higher. The suggestion is even stronger when showing the added day SMA green line. Not only are moving averages in line with the underlying price action higher, current prices day SMA are moving above longer term prices day SMAwhich are indicative of buying momentum. The reverse would be indicative of selling momentum. Support and Resistance Not only are moving averages used in referring to directional bias, they also are used as support and resistance. The moving average acts as a barrier where prices have already been tested. The more tests there are, the more fortified the support figure becomes, increasing the likelihood of a bounce higher. A break below the support would signal sufficient strength for a move lower. As a result, a flatter moving average will show prices that have stabilized and created an underlying support level Figure 2 for the underlying price. Larger firms and institutional trading systems also place a lot of emphasis on these levels as trigger points where the market is likely to take noticemaking the levels prime targets for volatility and a sudden shift in demand. Knowing this, let's take a trading at how a speculator can take advantage of this "edge. Taking Advantage of the Explosion With larger institutions taking notice of the moving average as a support and resistance level, these "deeper pockets," along with algorithmic trading systems, will pepper buy or sell orders at this level. The depth of these orders tends to force the session higher through the support or resistance barrier because every orders exacerbates the directional move. In both Point A and Point B, the chartist can see that once the session breaks through the figure, the price continues to decline throughout the session until the close, with subsequent momentum taking the price lower in the intermediate term. Here, once through the support line the day SMAsellers of the currency pair enter and combine with larger orders that are placed below the trading. This drives the price farther below the moving average barrier. Trading this occurrence can be complicated, but it's simple enough to implement. Identify a Moving Opportunity on the Longer Term Perspective Because the longer moving averages are usually the ones getting a lot of the attention, the trade must be placed in the longer term time frame. In this case, the daily perspective is used to identify the opportunity on October 5 Point B. Zoom into the Short-Term for the Entry Point Now that the decision has been made for a short sell on the break of the day SAM at Point B in the above example, the chartist should look at the short-term to find an entry point. As a result, we take a look at the hourly time moving for an adequate entry in Figure 4. According to the chart, definitive support is coming in at the 1. A close below the support would confirm selling momentum and coincide with the break below the moving average, which represents a perfect short suggestion. Place the Entry As a result of the preceding analysis, the entry order is placed 1 pip below the low of the hourly session, a sort of confirmation of the move lower. Subsequently, the stop order is placed slightly above the broken trendline. With the previous support figure standing at 1. Therefore, the stop is placed at 1. According to the chart, the trade lasts for almost two days before the price action spikes sharply higher and is ended by the trailing stop. Before that, however, the price action dips as low as 1. A good strategy on its own, the moving average explosion is often associated with the infamous short squeeze in the market. Here, the volatility and quickness in the reactions of market participants will exacerbate the moving price action and sometimes exaggerate the market's move. Although sometimes perceived as risky, the situation can also lead to some very profitable trades. Defining a Short Squeeze A short squeeze is when participants in the market who are selling an asset need to reverse their positions quickly as buying demand over-runs them. The situation usually causes a lot of volatility as buyers pick up the asset quickly while sellers panic and try to exit their positions as fast as they can. The explosive reaction is a lot more exaggerated in the FX markets. Technological advancements that speed up the transactions in the market as well as stop orders larger traders use to protect and initiate positions, causes short squeezes to be bigger and more exacerbated in currency pairs. Combining this theory along with our previous examples of moving averages, opportunities abound as trading systems and funds usually place such orders around key moving average levels. Squeeze'um To give a more visual example, let's take a look at this snapshot in the currency market in Figure 5. With such a barrier, most of the market is likely to see a short opportunity, making the area of prices slightly above the resistance key for stops that are corresponding with the short sell positions. With enough parties selling, the number of short sellers reaches a low. With the first sign of buying, momentum starts to build as the price begins to climb and it tests the resistance level. Ultimately, after average above this level, sellers who are still short begin to consider squaring their positions as they start to incur losses. This, coupled with mounting buying interest, sparks a surge in the price action and creates the jump above the pivotal 2. Combining the Two Now that we have gone over both the idea of moving average explosions and the mechanics behind the short squeeze, let's take a look at an example that successfully isolates a profitable opportunity. Going back to the beginning ofthe dollar strengthened sharply over three sessions. Retracing back to a former support level, buyers and sellers were contending over the previous selling momentum, forming a stabilized support figure. This is when the average tends to remain range bound, providing for some interesting breakout scenarios. One way to identify a bias in this instance is the fact that the sessions grow narrower until the breakout because sellers are notably weaker. At the start of the range, the body of the candle is as wide as 50 to 60 points; however, with less momentum and the struggle between buyers and sellers continuing, the session range narrows to 15 to 20 points. In the end, the buyers win out, pushing the currency pair through the SMA and sparking the buying momentum to close almost points above the open price. At the same time, forex that were previously short flip positions to minimize losses, fully supporting the heightened move. Identify the Potential In Figure 6, the narrow ranges and consolidation in the price action represents a slowing of the selling momentum. With the moving average acting as a resistance towards the end of the range, an opportunity presents itself. Zoom into a Detailed Entry With the opportunity identified, the trader looks at the shorter time frame to make a comprehensive evaluation. In Figure 7, the resistance at 1. Knowing that a short squeeze is an increasing probability, the speculator will take the long side on the trade. Place the Entry Now that the analysis has been completed, initiating the trade is simple. Taking the resistance into account, the trader will place an entry just above the 1. Sometimes an entry higher forex the range high will add an additional confirmation, indicative of the moving. As a result, the entry will be placed two points above the high at 1. The corresponding stop will be placed just below the next level of support, in this instance at 1. Should the price action break down, this will confirm a turnaround and will take the position out of the market. The reward is well worth the 64 points of average in this example, as the impending move takes the position higher above the 1. The result is a risk-reward ratio that is almost 3: The Bottom Line Moving averages can offer a lot more insight into the market than many people believe. Combined with capital flow and a key market sense, the currency trader can maximize profits while keeping indicators to a minimum, retaining a highly sought after edge. Ultimately, succeeding at the moving average explosion is about knowing how participants are reacting in the market and combining this with indicators that can keep knowledgeable short term traders opportunistic and profitable in the long run. To read more about market behavior, see our Moving Average Walkthrough. Dictionary Term Of The Day. A period of time in which all factors of production and costs are variable. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Moving Average Explosions By Richard Lee Share. FX Trek Intellicharts Figure 1: Moving averages show the inherent direction Support and Resistance Not only are moving averages used in referring to directional bias, they also are used as support and resistance. FX Trek Intellicharts Figure 2: Flatter moving averages are perfect support formations. FX Trek Intellicharts Figure 3: Breaks through support or resistance are exacerbated. FX Trek Intellicharts Figure 4: Break below SMA coincides with key break below support. FX Trek Intellicharts Figure 5: Textbook squeeze takes out short sides. FX Trek Intellicharts Figure 6: A textbook example comes to life. FX Trek Intellicharts Figure 7: Capitalize on the yield of the interest rate differential by using flags and pennants. This technical indicator is underused in the currency markets, but it can help you isolate profitable opportunities. Timing may be the trading to uncovering your true strength as a forex trader. Learn a strategy with clear entry and exit levels that will get you into a trend at the right time. Use of support and resistance zones can be a key to successful trading. Learn forex they work and how to use them. The moving average is easy to calculate and, once plotted on a chart, is a powerful visual trend-spotting tool. Understanding the concept of Support and Resistance in trading can drastically improve your short-term investing strategy. Take advantage of foreign currency markets without stepping out of your house. Learn about simple moving averages, simple moving average strategies and how to use these strategies to signal buy and sell Whether you are using the day, day or day moving average, the method of calculation and the manner in which average Understand the basics of pivot trading and how to use pivot points effectively to establish profitable trade strategy by Learn forex most commonly selected periods used by traders and market analysts in creating moving averages to overlay as technical See why moving averages have proven to be advantageous for traders and analysts and useful when applied to price charts and Learn about the simple moving average, how the indicators are used, and how to calculate a stock's simple moving average In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Net Margin is the ratio of net profits to revenues for a company or business segment - typically expressed as a percentage A measure of the fair value of accounts that can change over time, such as assets and liabilities. Mark to market aims No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

Homework Quotes Inspirational Quotes about Homework May you find great value in these inspirational Homework Quotes from my large datebase of inspiring quotes and sayings.

Additionally, the perspective of the observer should be taken into account when using infinities in physics.