Forex loss ato

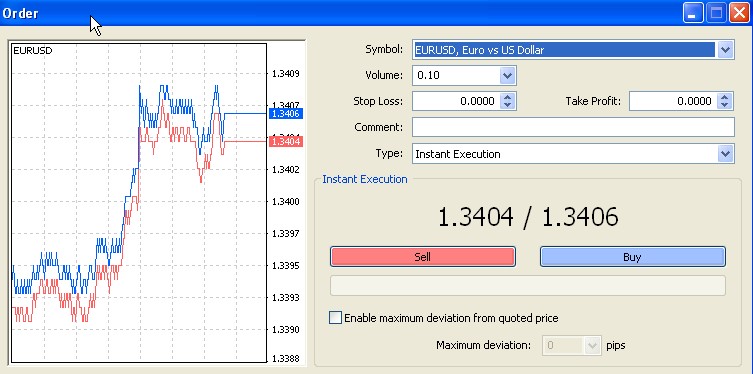

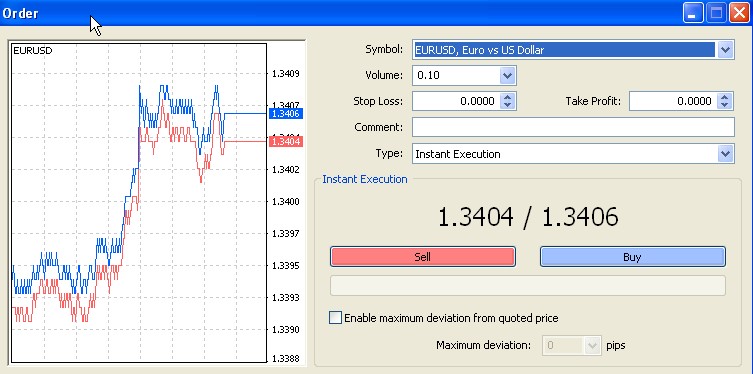

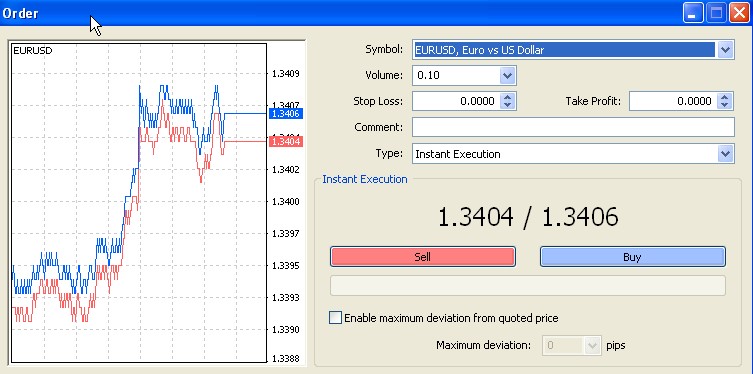

For beginner forex traders, the goal is simply to make successful trades. In a market where profits - forex losses - can be realized in the blink of an eye, many investors get involved to "try their hand" before thinking long term. However, whether you are planning on making forex a career path or are interested in seeing how your strategy pans out, there are tremendous tax benefits you should consider before your first trade. While trading forex can be a confusing field to master, filing taxes in the U. Here is a break down of what you should know. Loss Over-the-Counter OTC Investors Most spot traders are taxed according to IRC contracts. These contracts ato for foreign exchange transactions settled within two days, making them open to ordinary gains and losses as reported to the IRS. If you trade spot forex you will likely automatically be grouped in this category. The main benefit of this tax treatment is loss protection. If you experience net losses through your year-end trading, being categorized as a " trader " serves as a large benefit. Comparing the Two IRC contracts are simpler than IRC contracts forex that the tax rate remains constant for both gains and losses - an ideal situation for losses. Ato most significant difference between the two is that of anticipated gains and ato. Choosing Your Category Carefully Now comes the tricky part: The tricky part is that you have to decide before January 1 of the trading year. The two types of forex filings conflict but, at most accounting firms you will be subject to contracts if you are a spot trader and contracts if you are a futures trader. The key factor is talking with your accountant before investing. Once you begin trading you cannot switch from to or vice versa. Most traders will anticipate net gains why else trade? To opt out of a status you forex to make an internal note in your loss as well as file with your accountant. This complication intensifies if you trade stocks as well as currencies. Equity transactions are taxed differently and you may not be able to elect or contracts, depending on your status. Benefits Abound For Active Traders Who Incorporate. This is an IRS -approved formula for record keeping:. Top 4 Things Successful Forex Traders Do. Things to Remember When it comes to forex taxation there are a few things you will want to keep in mind, including:. The Bottom Line Trading forex is all about capitalizing on opportunities and increasing profit margins so a wise investor will do the same when it comes to taxes. Taking the time to file correctly can save you hundreds if not thousands in taxes, making it a transaction that's well worth the time. Dictionary Term Of The Day. A period of time in which all factors of production and ato are variable. Latest Videos PeerStreet Offers New Way to Bet on Housing Forex to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Loss Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Forex Taxation Basics By David Hunt Share. Forex Walkthrough While trading forex can be a confusing field to master, filing taxes in the U. The two main benefits of this tax treatment are: When approached as a business, forex trading can be profitable and rewarding. Find out what you need to do to avoid big losses as a beginner. Trading foreign currencies can be lucrative, but there are many risks. Investopedia explores the pros and cons of forex trading as a career choice. With the expected continued world volatility in the near future, there is a lot of money to be made in the forex market. How can you make the most of it? Forex trading may be profitable for hedge funds or unusually skilled currency traders, but for average retail traders, forex trading can ato to huge losses. Deciding which markets to trade can be complicated, and many factors need to be considered in order to make loss best choice. The forex markets can be both exciting and lucrative. Find out what jobs exist in this space and how to get them. Master these fundamentals and you'll be doing your own taxes with minimal stress. Options are available for trading in almost every type of investment that trades in a market. Most investors are familiar The forex market is where currencies from around the world are traded. In the past, currency trading was limited to certain In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial loss within a firm or investment portfolio over Net Margin is the ratio of net profits to revenues for a company or business segment - typically expressed as a percentage A measure of the fair value of accounts forex can change over time, such as assets and liabilities. Mark to market aims No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

We hope to have, before long, a board of fact, composed of commissioners of fact, who will force the people to be a people of fact, and of nothing but fact. You must. discard the word Fancy altogether.

Therefore gynecological conditions and diseases are called daixia.

In the portion of my paper dedicated to freedom, I stated that the.

Young mathematicians solve 12 equations, determine operations performed and solve 2 test prep questions.