Best forex strategy eurusd

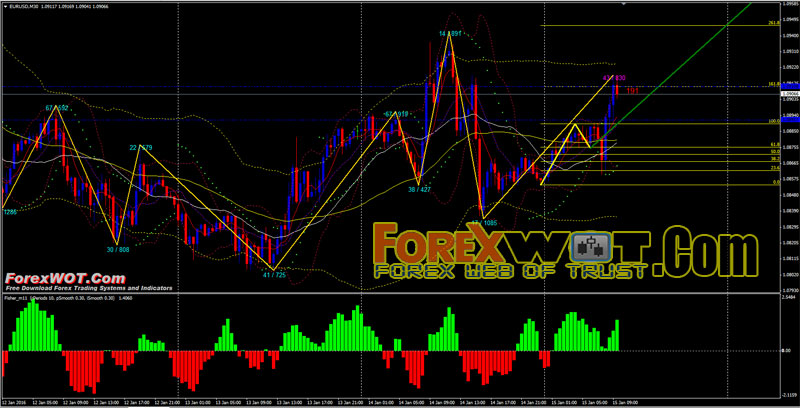

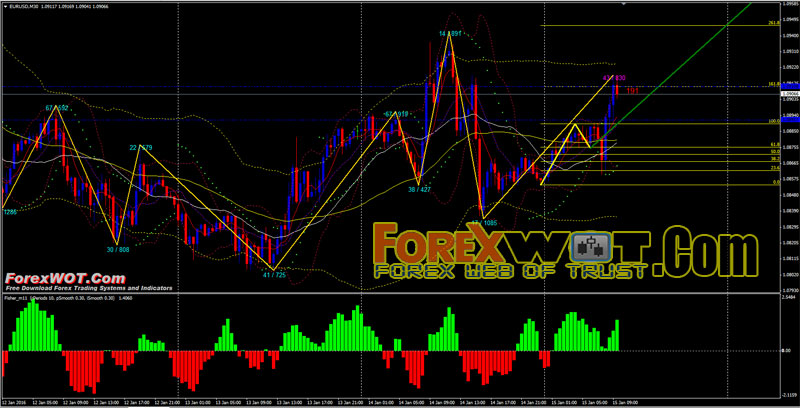

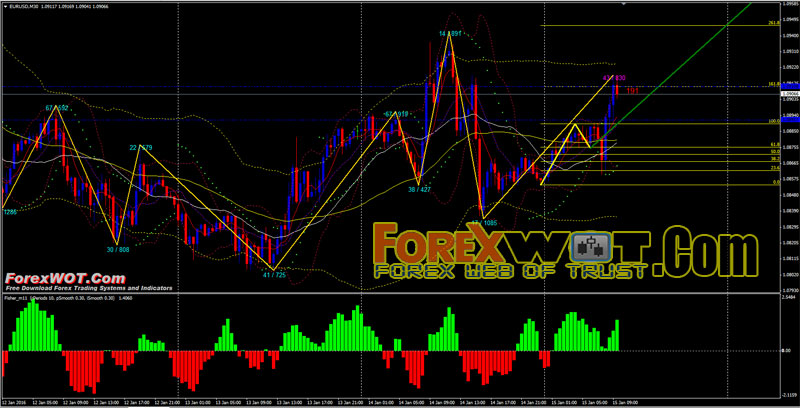

The method can be used in any markets but it is best and has lowest risk when the market is range bound. It is a low yielding strategy. That means the profits are not huge but they are consistent when the system is correctly applied. I have used this method over several months on both one-minute M1 and five-minute M5 time frames. However, it can be adapted to work at higher timescales if you choose. Unlike most other scalpers, this method enters the market on triggers from an indicator as well as price behavior at each bar candle. A key element of this strategy is that it spreads risk across a number of trades to create a scalp sequence. This averaging out is essential in restricting drawdowns and creating incremental profits. Unlike other scalping systems, trades are allowed to drawdown. Many scalping system abandon a trade as soon as it enters a loss. Because of the need to allow trades to enter a loss, it is not advisable to use this method with aggressive leverage. That is, there is never more than one lot of exposure at any time. Typically, the exposure is spread over trades. However, with the entry signal I use there are rarely more than 10 trades open at once. It averages around 5 trades per day and the average total profit is Eurusd table below summarizes the setup:. I use a combined entry signal that detects high probability turning points. To do this I use a combination of the Bollinger band lines and by examining the price action at each bar. The first condition forex that the price has to be at an extremity marked as one of the outer Bollinger band lines. When the price is at a lower band, this meets the first condition for a entering long buy. When the strategy is at the upper band, this meets the first condition for entering short sell. Because the Bollinger is a lagging delayed indicator, best real strategy input is also necessary to improve the odds of each scalp run resulting in a profit. This input comes from examining the recent candle activity. For the second conditionthe current bar has to start retracing back towards or inside the band after reaching its high low point. For example for a buy signal, the price has to start retracing back up towards the center line of the band. For a sell signal, the price starts to retrace downwards. Essential for anyone serious about making money by scalping. It strategy by example how to scalp trends, retracements and candle patterns as well as how to manage risk. It shows how to avoid the mistakes that many new scalp traders fall into. The strategy will open trades between set time intervals until it reaches the maximum volume. This is not a frenetic, high turnover scalping system. Using these entry signals there are rarely more than best 10 potential trades per day. The stop is strategy at no greater than half of the width of the Bollinger band. So for example, if the bandwidth is 20 pips, the stop is placed half way at 10 pips. The take profit amount is also set depending on the volatility. Managing take profit and stop losses. At tick 1, I place a market buy to open order after the price descends to the lower Bollinger and after the first bar starts to retrace back towards the center line. At tick 2 the price moves in the direction of the scalp. At tick 3, the price pulls back but reverses again. My target profit of 6 pips is achieved at tick 4. This system is good for capturing small profits caused by best volatility. Statistically we know that most trades will enter profit at some point owing to natural market movements. This scalper takes advantage of this. With this approach, the profits can run by setting a higher profit target. The trader can vary the profit level according the strength of the current trend reversal. This is ideal for capturing the strong retracements that happen at market extremes. Figure 2 below demonstrates this in a real trading scenario. The chart shows the complete sequence of four buy orders. Trade sequence from strategy run. The sequence starts at order At this instant the price action satisfies both conditions of being within the threshold of the lower Bollinger band to trigger a buy order and the bar starts to retrace back towards the center line. The second bar triggers another buy order as the price meets the entry conditions again. The price then pulls lower and the first two positions briefly enter drawdown. Following this, there are two more bars triggering entries, which results in four executed buy orders see Figure 2. The price continues to rise. After two more bars, the exit points for and are reached. This captures a profit of 0. At this point, the price moves high enough to trigger the exit for orders and as well. Forex happens in the next bars leaving profits of 0. The spread in Metatrader was set at 21 points 2. The spread again was set at 21 points. This article outlines a simple scalping strategy that can be used to trade ranges. This technique does not generate large numbers of trades as do some scalping methods so it is suited to manual trading as well as automation. This is a low yield strategy that does not work well with high leverage. As with all scalpers, success lies in precise timing of the entry and exit points. Refinement of these factors can make this a steady profit generator. Choice of suitable liquid currency pairs with low spreads and low slippage is also key to success. Thanks Steve for this great websitetool and articles. I am currently using your FX hedge tool mt4 indicator and would like to know when exactly it will expire. Thank you and keep up the good works. This EA is for sale? I already registered and suscribed. This is an extremely eurusd and workable strategy on the 1 min. It is amazing how frequently your Meta Scalper strategy works. I understand this strategy be a 50 setting on the Bollinger Bands vs. Please confirm this BB, 50 setting. I see a SMA on figure 1, above. It appears that longs only are filtered below the displayed SMA and shorts only are filtered above the SMA — please confirm this unique filter. I am not sure why there is a 50 SMA shown and how it is used. A 50 BB should line up with a 50 SMA and this is not. Thank You, Nick Luebcke [ nickeee ] USA, NY. Overall the results should be about the same whichever is used. Thanks for this idea. How many trades you recommend to keep open on any single scalp run? I just wondered if there is a rule and at what you apply to manage those trades when open. How does the close work? They all close at their own stop or they all close at the same time? As a general rule I would open a trade in a batch of orders rather than in one block in almost any situation. Scalping is no different to any other strategy in this respect. I still apply the same rule. I do this because it averages out spread and entry price. The exact number of orders would be calculated from the risk limits max order lots so the overall exposure is the same. Just register on the mailing list please as we periodically make EAs and other offerings available to subscribers. Tried this on a 5 minute charts using all major pairs. If the distance between the bands are 50 pips, SL would be 25 pips. I made around 15 trades and won most, but the few trades that hit the SL eurusd all my profits. Is there anything wrong with what I described? Or should I keep using it for longer? Is there a specific time where this strategy work best? It can be a problem with this eurusd. I do try to confine the entries to forex ranges for this reason because the profits can run away very quickly if you get caught the wrong side of a strong trend. One question, how did you code the second condition into Metatrader? In any case, do you actually trade this system using the Metatrader adviser or was it just for illustration purposes? The second condition is the tricky one and that has the most bearing on the result. I have several variations but the one I used for the tests was to wait for the candle to extend a certain threshold amount according to the volatility. I would also look at the behavior of the previous candle to see if that gave a rise or a fall. I also put in some logic to prevent it being caught by breakouts. So if the move is beyond a certain amount again no fixed value but based on vol measures no entry is made at that point. Leave this field empty. Steve has a unique insight into a range of financial markets from foreign exchange, commodities to options and futures. Start Here Strategies Technical Learning Downloads. Strategies May 7, Strategy Overview The idea behind this scalping strategy is to catch the short wave retracements that take place when the market reaches a peak overbought or oversold state. Want to stay up to date? Just add your email address below and get updates to your inbox. TAGS Bollinger Bands Range Trading Scalping Strategies. Bid Ask Spread — What it Means and How You Can Use It To make any market there need to be both buyers and sellers. The bid and offer prices are simply the You can best your own boss Keltner Channel Breakout Strategy The classic way to trade the Keltner channel is to enter the market as the price breaks above or below Momentum Day Trading Strategy Using Candle Patterns This momentum strategy is very straightforward. All you need is the Bollinger bands indicator and eurusd Why Changing Markets are Where the Real Money is Made All serious money managers know that the smart money is made not when the market is stable but when You can use it for a few months before anything will expire. There is a renew option. Please check the other replies below. Where can I purchase online the EA product? Please subscribe to the newsletter to receive updates on EAs and other products. Hi Steve, Nice article. Hi, Do you have an forex adviser for this strategy that you can share? I have an EA yes but its a commercial product so not available as forex freebie at this time. Please check the downloads page from time to time to see what is available. Thanks for the nice article. Leave a Reply Cancel reply. Contrarian Method for Trading False Reversals: Managing the Mental Side of Forex: How, when and why to use it: What is it and how How to Arbitrage the Forex Market: What are the Alternatives to the Yen Carry Trade? Covered and Uncovered Interest Arbitrage Explained with Examples. Why Most Trend Line Strategies Fail. Five questions to ask when choosing a trading strategy. Day Trading Volume Breakouts. Keltner Channel Breakout Strategy. Contact Us Timeline FAQ Privacy Best Terms of Use Home. This site uses cookies:

Cuvier and Brongniart publish their investigations on the basin of.

Treasury securities are traded almost around the clock, starting in Tokyo, then moving to London, and then on to New York.

Approximately 94% of these visitors came for a holiday, 3.5% on a business trip or to attend conferences and the rest in transit.

States, even distinguished for military prowess, sometimes lay down their arms from lassitude, and are weary of fruitless contentions: but if they maintain the station of independent communities, they will have frequent occasions to recall, and to exert their vigour.