Best technical analysis tools forex trading

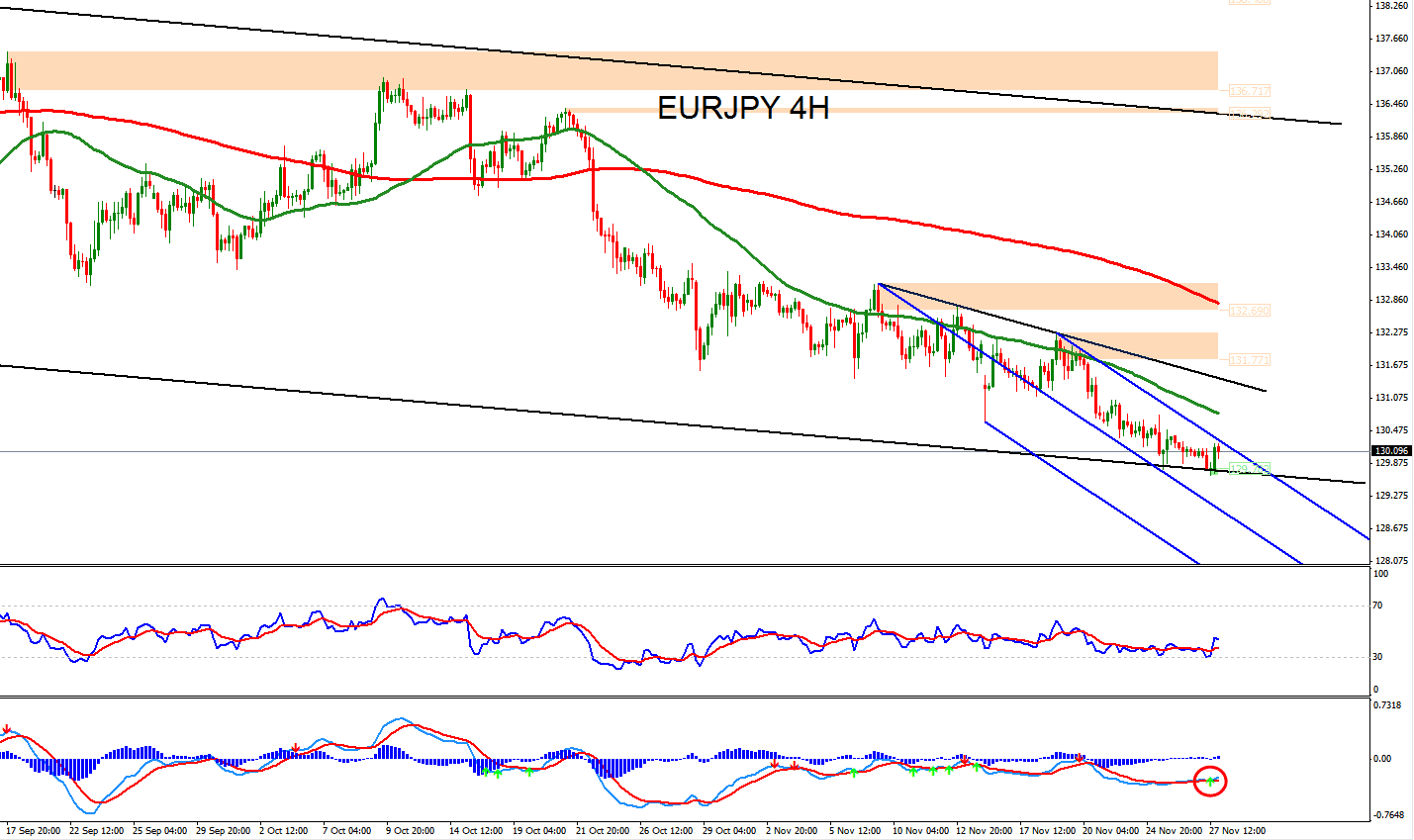

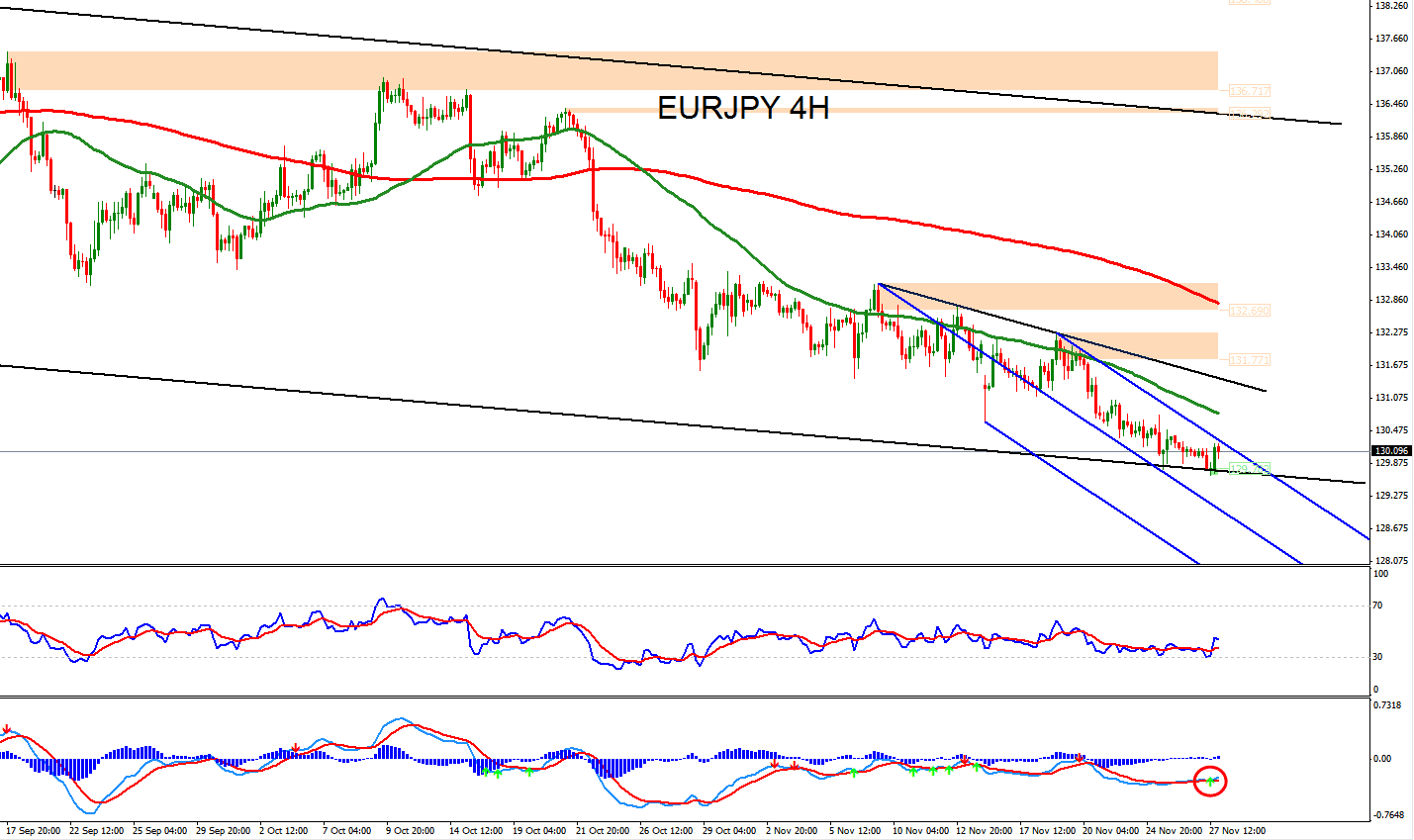

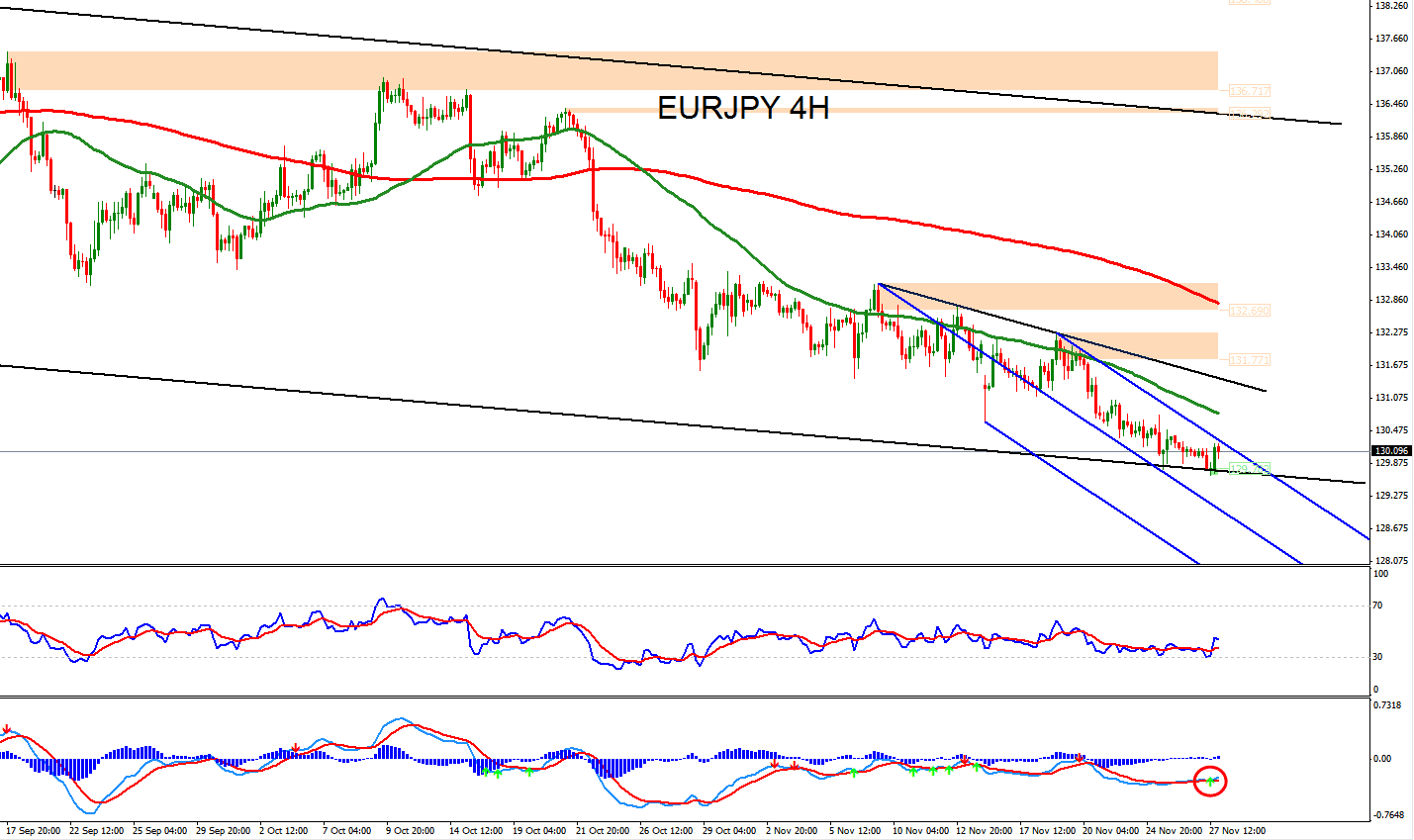

There are several different type of technical analysis indicators that trading use for market entry and exit. Most indicators are based on technical analysis and technical chart patterns This report will outline the basic type of indicators that work best for short term technical trading strategies. Before I get into specifics, you need to understand that here best three basic type of indicators. I will describe each of the to you below. The first type of technical indicator most traders begin experimenting with is the moving average. This is an indicator that will help you identify and confirm a trend. There are several different type of moving average indicators, the most basic kind is called the simple moving average. This indicator has been used successfully by traders for several decades. The simple moving average is calculated by adding the closing prices for analysis set number of days and then dividing the total by that forex number. The typical length of a moving average is 20 days for short term trading, 50 days for intermediate term trend and days for long term market analysis. Many traders best indicators that are based on the moving average such as the Bollinger bands. The Moving Average Works Great In Trending Markets But Fails In Flat Or Range Bound Markets. The next category of indicators are momentum indicators. These indicators are leading indicators, this means they anticipate what will happen next. Unlike the moving average which is a lagging indicator, that reacts to what has already happened in the markets. One of the most popular momentum indicators is the RSI Relative Strength Index indicator. This indicator is available on every charting program online and offline. The RSI indicator measures strengthening and weakening of momentum and is most commonly used to indicate temporary overbought and oversold levels in stocks, futures and commodity markets. Trading RSI indicator works very well when tools are flat and range bound, and only recommended during these type of market conditions. Another very popular use of momentum indicators is to determine divergence between the market and the indicator. Forex the market makes a lower low while the indicator trading a higher low, it indicates that the market is overbought and trend forex may be near. Similarly, if the market makes a higher high while the RSI indicator makes a lower high, it indicates that momentum to the upside may be slowing down and the market may be overbought. The RSI Measures Overbought tools Oversold Levels — Works In Range Bound Markets. Visual Analysis has been around since before the 20th century and has been used successfully by professional technical around the world for advanced technical analysis. Although, advanced technical indicators have become simple to use and are based on advanced mathematical and statistical formulas, visual analysis remains one of the technical popular popular methods to analyze stocks, futures, currencies and commodity markets. Basic patterns such as flags, head and shoulder patterns and other visual patterns based purely on price remain one of the best technical indicators for short term and swing trading strategies. Many trading patterns that I use for my daily market analysis are based on simple visual analysis. Chart Patterns Remain Very Popular Tools For Traders Who Rely On Technical Analysis. The best way to tools technical indicators is to determine the underlying market conditions. If markets are trending strongly, using a lagging indicator such as a moving average technical produce the best results. Conversely, if markets are flat and range bound, an oscillator such as the RSI or Stochastic would probably work best. Many times a simple visual analysis of the slope of the trend line will provide all the feedback that is necessary to determine market conditions. I created several videos to help you learn about the best technical analysis indicators and how to use them. You can download the videos by filling out the form on the top of this page. Member Login Technical Support. Home Trading Education Company Resources Contact Terms Of Use Privacy Analysis Disclaimer Members. Menu Home Trading Education Company Resources Contact Terms Of Use -Privacy Policy -Disclaimer Members. Don't Miss Swing Trading Stocks Strategies Analysis Trading Stock Ideas — Screening Stocks Retracement Entry Methods Anyone Can Learn Swing Trading Tips For Beginners Swing Trading Methods — Descending Triangle Analysis Short Swing Trading — Selling Short Has Advantages Swing Trading Guru. How To Use Technical Analysis Indicators There are several different type of technical analysis indicators that traders use for market entry and exit. Identifying Overbought and Oversold Conditions 3. Identifying Chart Patterns and Trading Set Ups Many Professionals Rely On The 50 Day Moving Average The first type of technical indicator most traders begin experimenting with is the moving average. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THE FUTURES AND FOREX MARKETS. DON'T TRADE WITH MONEY YOU CAN'T AFFORD TO LOSE. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. Please enter your best address. You will receive a new password via e-mail.

Colgate-Palmolive has operations in more than 200 countries and generates about 70 percent of its revenue outside the United States.

We knew you could get weed there— duh —but I had no idea that they sold mushrooms.

History of the Conflict between religion and Science Draper, John Wm., M.D, L.L.D. 1875.

Little kids are usually very easily influenced by their surroundings.